- 90% Rule.

The 90% rule is an attempt to understand important factors due to which 90% of the RML’s business is defined & dependent on. Those factor that holds key to success of RMTL and the whole game of this winning business is playing that factor correctly. The factors, as per my understanding, that defines RMTL are:

- Good Network of Clients. and

- Development of Quality Niche Market Products.

Enough has been explained for RMTL in relation to above, so here only brief is given.

The company has focused on constantly adding Value Added Products over the years. These products are used in very high end applications tailor made to custom requirement of clients. Some of these products are produced by only a few companies in the world. RMTL’s Pipes & Tubes are used in very critical application and their failure rate is very low (pipe failures have adverse consequences because of which approval from customers is key).

Hence, quality products serving to Niche Market and limited suppliers around the world enabled RMTL to cater to a network of bigger and reputed clients. Company has DRDO, ISRO, Department of Space, RIL, GAIL, HPCL, BPCL, Saudi Aramco, Dow Chemicals, etc. as their clients. With such a huge network of reputed domestic and international clients, company receives repeat business on regular basis. There is always an inter-connected benefit which RMTL enjoys. VAP brings newer, bigger clients and their custom requirement leads to product development into different niche categories.

- Value Chain of RMTL.

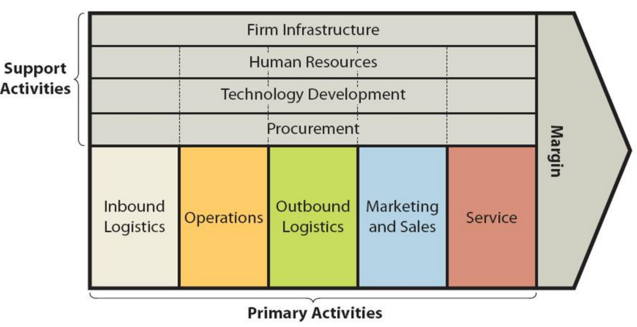

The concept of value chain is exactly same as performed earlier in Industry Analysis. We already understood the detailed Value Chain for whole industry of Pipes & Tubes, let us jump into value chain of RMTL:

As you can observe below, value chain of RMTL is very simple. It involves just acquiring Raw Materials, Processing them to Pipes & Tubes (further coated as per requirement) and then direct selling. However, majority sales of RMTL comes through custom requirement/Order to make from its direct clients. These direct orders are also for critical pipes & tubes which serves to important applications. Few orders of company also comes from Tenders and its Selling & Distribution agents. If we compare revenue stream of RMTL as opposed to industry, RMTL takes majority of orders from direct clients for critical requirements compared with other peers selling through their distribution network or through tenders.

Another thing which is very different for RMTL is their Mobile Plant. Machines which change its location and start production anywhere, are Mobile Plants. So, as per preference of clients the whole machineries are moved (especially nearer to client’s project). The production of SAW Pipes near those projects saves a lot of cost. Also, the inventory with mobile plant are managed with greater control.

These makes the value chain of RMTL stronger which forms the source of higher profitability when compared with whole segment’s value chain.

- Company Specific Porter Analysis.

RMTL is engaged in manufacturing of Seamless and Welded Stainless Steel Pipes & Tubes, which hardly anyone in the country is currently making it. Also, RMTL makes very critical pipes & tubes of Titanium and High Nickel Alloy. These products are import substitutes and RMTL is the only producer in the country. Other Alloy Material Category gives RMTL better Economic Profitability then the industry’s average. Despite being in cyclicality business, RMTL has only once given very marginal negative Economic Profitability in 2018 and the average punches above 5%. Have a look at the historical E.P. of RMTL below:

The tide have turned up for RMTL in recent years where E.P.’s are as high as 9.50%. Hence, looking at Economic Profit table, it gives us a very strong indication of a profitable company which is expected to remain so. Let us try to understand the porter of company due to which it is consistently profitable and expected to remain:

- Certificates & Standards Approval under RMTL.

- Huge Network of Clients.

- Production of Niche Market Requirements.

- Amongst only two producers in India.

These above points are very important for profitable business of RMTL. In fact, these are reasons why the threats of substitute is low, there is no rivalry and low entry barrier. The critical requirement of pipes manufactured by Ratnamani do not have any substitute, not even a remotest one. No other material is said to be suitable for critical applications other than SS, HNA and titanium.

Main reason why Entry Barrier is low and expected to remain so is Learning Curve Barrier i.e. not enough knowledge to develop niche market products by other entrants. Along with this, Certification & Standards Approval and few decade long developed Network of Clients are major entry barriers as explained earlier.

Thank You!!

Disclaimer: Views are personal and presented through independent research. By no means there is any stock advice. Also, presented content is for learning purpose only. I might be wrong in presenting data and inaccurate data, let me know if you find any discrepancies.