Steel is almost used everywhere – Buildings, Infrastructure Development, Automobiles, Consumer Products, and endless industries…

Steel is almost used everywhere – Buildings, Infrastructure Development, Automobiles, Consumer Products, and endless industries…

RMTL is in business of steel pipes & tubes, which is prone to cyclicality. Valuations […]

Management are the only ones who officially runs the company, responsible for Revenues, Profits and […]

We understood whole business of Ratnamani Metals, right from Product Mix, Revenue to Costing. However, […]

Fund Flow analysis will help us to judge how the funds have been utilized by […]

Value Added Product (VAP) is an important source of higher profitability for any company. But, […]

“Earnings per Share (E.P.S)” is very important item through which the performance of companies Y-o-Y […]

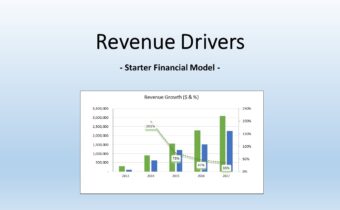

The way we estimated Revenue of the company, similarly we need to do it for […]

We performed Industry Analysis of our segment i.e. Steel Pipes & Tubes, wherein Opportunity Size […]

Ratnamani Metals & Tubes Limited have consistently earned Economic Profit over the years. It is […]

90% Rule. The 90% rule is an attempt to understand important factors due to which […]

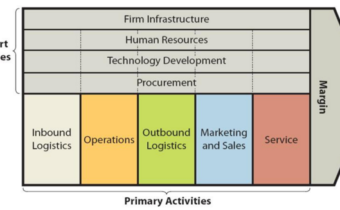

Through the help of Business Model Canvas, we will try to understand only the precise […]