The money which is owned by someone else but it is in our possession (i.e. with us) and needs to be repaid back without any interest or costs attached to it, is the money we say as Other People’s Money (OPM). In simple terms, we received from Mr. A Rs. 1,00,000/- and after a year we need to give it back to Mr. A the original amount of Rs. 1,00,000/-, then this money is called as OPM.

Now, the better part of OPM is that we earn by investing this “others money” i.e. in other words we get the money from Mr. A, we invest the same in Fixed Deposit at say 6% for a year and earn Rs. 6,000/- interest, and we repay the exact amount of money to Mr. A. Hence, we earned Rs. 6,000/- on Mr. A’s money without even putting a penny of ours.

Example: Security Deposits on rented flat.

We own a flat we have rented out. Now, apart from rent we also receive security deposits from the tenant. As far as we continue to keep the flat rented, the security deposit amount will remain with us. Even though the tenants change, it will only be matter of paying back the security deposit to old tenant and receiving back the deposit from new tenant. Hence, this amount of security deposit, although of other people, will continue to remain with us. Only the tenant will change and money will exchange hands, but we will have the possession of the money. This money, we call it as float and hence will be used to earn extra rate of return for us as far as the money remains in our account.

And the best part is, most of the reputed high advantageous business enjoys this concept and earns extra income apart from usual business profits and thus increasing their overall returns. These business are advantageous on the basis that they have some competitive advantages over other businesses with respect to brand, patented goods, monopoly structure, product quality, strong networking, etc.

Now the question comes: Why do people gives their money to these business and does not instead keep it with them? Answer to which follows and well explains the concept of Float and Moat.

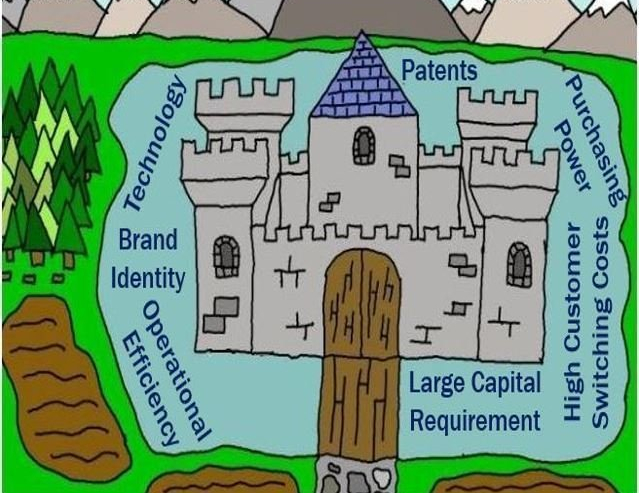

Moat is deep, broad ditch that is dug around a castle so to protect the castle’s richness from the outsiders. And from this concept of Moat comes the Economic Moat. Economic Moat is a business’s ability to maintain competitive advantage in order to protect its long term profitability and market share from other competitive firms. Most consistent high earning business usually have this advantageous Economic Moat which helps them to earn high profit for extended long period of times.

And also, Economic Moat and Float goes hand in hand. Float and OPM has similar concepts and Float is the money that we are holding that will eventually go to other people, but of which we have temporary possession. Hence, by using float we can again earn return on temporary money of others.

So, let’s try to understand the concept of combining Moat and Float. Let’s say Asian Paint’s. Asian Paint have one of the best networking of dealers, customers across the country it operates. And also, due to so much of large operations, it manufacturers paints and require raw materials in huge quantities. Now, because it purchases raw materials, it has that buying advantage to ask for favourable terms from its suppliers like more credit days, higher discounts, etc. And due to its best networking system, high product demand and very good I.T Infrastructure, Asian Paint’s dealers almost pay them in advance to buy the products.

Hence, the Economic Moat here or in other words competitive advantage is of good networking, high demand, IT Infrastructure, etc. which helps Asian Paints to remain the best in the market while there is still competition of other players. Because of these competitive advantage, it enjoys advance receipt from the dealers and late payment to its suppliers. And hence, this Moat helps to get a better float i.e. the time lag of receiving money early from customers and paying the creditors’ late, helps Asian paints use the excess money for that time lag difference. Also, there is no cost involved in it and added to this is the nature of transaction of payables and receivables, which are business transaction and are continuous in nature hence this excess time lag will always be enjoyed by the company.

Important pointers for Moat and Float (Financial Terms):

- Whenever you find large negative working capital, absence of debt, a liquid balance sheet and high ROCE, it’s very likely a result of Moat.

- A better Moat also means good Float. Because companies with competitive advantage will enjoy good terms in market, and hence increasing their floats.

- When Moat quality deteriorates, float will go down. As moats improve, floats will also go up.

- Hence, Floats and Moats go together.

Hope you all are clear with the concept related to Moat, Float and OPM.

And yes! I am able to prepare this article from the following sources:

- Capital Mind’s Blog – https://www.capitalmind.in/2020/02/opm-other-peoples-money/

- Prof. Sanjay Bakshi Sir’s Anaysis on Floats and Moats – https://fundooprofessor.wordpress.com/2012/12/06/httpsdl-dropbox-comu28494399blog%20linksfloats_and_moats-pdf/

- A bit of Google.