Steel is almost used everywhere – Buildings, Infrastructure Development, Automobiles, Consumer Products, and endless industries. This makes steel virtually a backbone for any economy and country. The importance of which is realized by the Indian Government and hence, there is a thrust to improve steel production to meet ends for self as well as growing demand of the world.

The government has planned to increase steel output drastically by 2030-31 in its visionary “National Steel Policy” launched in 2017. It plans to have a capacity/production of steel at 300 million tonnes as against 110 million tonnes in 2019. This output if achieved would mean a 9.55% CAGR from 2019 to 2030. Complementing this vision is the “National Infrastructure Pipeline (NIP)”. NIP, launched in 2019 has aimed to fast-forward the development in the country with a project outlay of a whopping Rs. 140 lakh crores. With this huge outlay, the sector under bright and direct spot is obviously, “Steel”.

So, the main question is how good is this anticipated 9.55% CAGR? An understanding of the past and a detailed analysis of various aspects of steel will help us understand this piece of the puzzle. And this is done by breaking up parts as given below:

- Global Crude Steel Market and Indian Crude Steel Market.

- Classifying Steel.

- Factors (Risk and Advantages) affecting Indian Steel Sector.

- Understanding Production Process and Value Chain.

- Profit Pool Analysis to select the best segment in Steel Sector.

So, let us understand each sub-point one by one.

- Global and Indian Crude Steel Production Comparision.

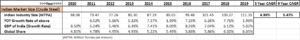

To put 300 million tonnes production of capacity in perspective, comparing Indian Production, Indian Steel’s historic growth and Global steel levels would gain actionable insights:

From the table above, there are three things clearly emerging for Indian Steel’s future. 1) The historical growth from 2010 has been in the range of 5%-5.5% as against the target to achieve 9.55% by 2030. 2) The growth rate of Steel on a yearly comparison is highly linked to the GDP growth of India. And 3) The Global Share of Indian Steel has moved upwards swiftly from 4.81% in 2010 to 6.05% in 2019.

This clearly states that Indian Steel Output growth historically has been higher than the global steel confirmed by the gaining global share. And if 9.55% of growth till 2030 is achieved then there are the global share gain could accelerate faster.

And there are cues why Indian Steel is poised to grow higher than India’s own historical average as well as the global average:

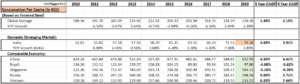

Per Capital Consumption (In KG) for India is very low as compared to the comparable developed economies like China, Brazil, Russia, Vietnam, etc. India stands at a mere 75 Kg per capita consumption as against the Global average of 230 Kg and a comparable emerging economy of approx. 200 Kg. This means that India is highly under-developed and there is a huge scope of growth going forward in steel consumption as development picks up. (National Infrastructure Pipeline is a step towards accelerated development).

Also, when you observe the data, China is the leading country i.e. it produces 50% of the world’s total output. And there are triggers here favoring India as the first choice of supplier ahead of China. The two most important triggers are 1) the COVID outbreak wanting buyer countries to go for China +1 and 2) the Cost of production in China going up meaning Chinese steel getting expensive.

See, India is 2nd largest producer in the world after China even with only 6% of the Global share. The gap between China and India is huge. Imagine in the world after COVID, where multiple countries have reduced their purchase from China and going for an additional supplier (China +1 strategy), who is the next best country to capture this opportunity? India! Being the 2nd largest producer. This is also complemented by the fact that government policies want Indian production to go upwards to 300 million tonnes.

And Secondly, China itself is reducing its production for pollution concerns. Steel Plant is one of the highest polluting industries worldwide. So, an upgrade in new plants and machinery is required to keep pollution levels in check. It has been found that most of the steel plants in China are operating with very old technology where they are emitting huge amounts of carbon into the environment. So, when plants in China shut down due to pollution concerns (curbed by the Chinese Government) either new machinery is replaced or the plant is closed down. In such a case either the cost of production will increase or the output will reduce for the country as a whole. And this is a huge benefit as there is India waiting to catch any shortfall vacated by China.

So, from an overall perspective, the Indian picture looks rosy for the next few years till 2025 because of the following: 1) China’s production reducing due to closing plants. 2) National Infrastructure Pipeline to help increase steel demand and steel consumption per capita and 3) COVID-led push to benefit India.

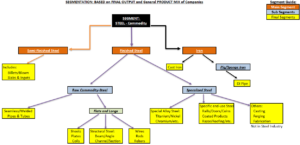

- Classifying Steel into various segments and sub-segments.

Although India, from the above data, looks like will grow nicely in terms of steel production. But not necessarily every category of steel will grow. Yes, there are different steel categories and they are divided into broad segments. And understanding these segments is important to gauge where most of the value in terms of growth and profit lies. A simple Segmentation and further sub-segmentation can help to understand broad categories of steel as below:

As you can see, Steel has various types and hence the categories are diverse as well. One can do segmentation in many ways I.e., Market it serves, Product it makes, etc. Most analyst segments the steel industry by Flats and Longs. The main purpose however is, irrespective of what segmentation is used, to fall in that segment that has the highest prospect of growth along with good profitability. As those will be the areas where the most value lies. And to find the segment where there is the most value; you need a broad perspective of each segment.

We will come to the part where we judge the broad perspective of each segment through some historical numbers in the later part of the reading.

- Risks and Advantageous Factors affecting Steel Sector as a whole.

Each segment has different prospects for growth and profit margins. But it is not necessarily their historical growth and profits will continue in the future as well. Their growth and profits can take a different path as we go into the future and it all depends on the Risk the company faces and the advantages the company is having. A simple risk and advantage chart is made below to understand how the steel sector as a whole has been affected by various factors:

From the above we can understand that:

- A good Economic Outlook or Economic Growth in India is good for Steel Sector (as seen in the very first table). However, A bad Economic Outlook for India and for China means over-capacity in steel and reduced growth and profits.

- Similarly, Government Support and Policies are important parts of shaping up the steel sector.

- Cheap Raw Materials and Higher Finished Goods mean low cost of production with higher selling price and a profit margin expansion.

- Transport is main here because the bulky steel re-location from one place to another is quite expensive. Its cost equals 3-6% of sales.

- The steel sector historically had a pile of debts and hence cheaper financing becomes one of the factors to judge the profit composition.

- Old Plant & Machinery means more maintenance costs and bad quality steel output. The latest technology Plant & Machinery is required although it takes initial high set up cost.

So, when you study each segment, sub-segment, or even company, you will realize how important these factors are. And through these factors, you could broadly have a hang on to the segments & sub-segments in terms of risk and advantages.

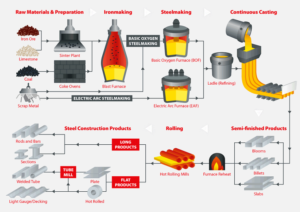

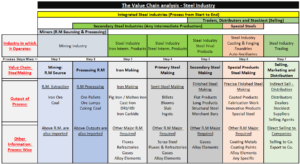

- Understanding Steel Production and a detailed Value Chain.

Each part of the steel segment we saw starts with two basic materials as the first step in production I.e.; Coal and Iron Ore. With these two materials Finished Steel, Semi-Finished Steel, Iron, Flats, Longs, etc. are made. An additional level of production gives a higher quality of steel output with the desired shape and strength and thereby adds value. The complex production process of steel is given in a simplified manner in the below process image:

Iron Ore with Coal and Limestone is burned at high temperature in a machine called Blast Furnace. This process is called Ironmaking and iron is formed here through chemical properties present in Coal and Iron Ore. When this Iron is further heated at higher temperatures with Oxygen as a heating agent, the chemical reaction with Oxygen forms steel and hence called Steelmaking. Steel can also be made by burning Scrap Steel and this takes EAF Machine. Hence, steel is made through two processes: 1) BOF: using Iron Ore and Coal and 2) EAF: Using Scrap Steel.

At such high temperatures, liquid steel is formed and it can be shaped as per the requirement. The molten steel is passed through Moulds (which gives shape) and they are hammered/rolled/pressed to form the desired shapes i.e., Round, Square, etc. You can see the pictorial presentation above where it is quite clear how the steel is formed.

This steel output can be further heated to make it harder or add more chemical elements to form high-quality precise steel. Steelmaking is not an easy process as it required huge manpower, huge temperatures to work with, and a number of chemicals to adjust the hardness and chemical composition of the steel.

Different industries require different chemical compositions and hence same flat or longs could have different chemical properties. Example: A nuclear plant deals with very risky and reacting chemicals and hence the quality of steel needs to be very high and so they are made with the desired chemical composition that makes the steel even harder, non-corrosive, and so on. The more the customization in steel, the tougher will be the production process and the better will be the price realization and margins.

Based on the production process we saw above, the steel-making process adds value at each production step. These steps can be visualized but easily understood through the Value Chain below:

The companies which make steel from Raw Materials till distribution (Step 6) are called Integrated steel producers. There is Iron Industry, Secondary Steel Industry, Steel Selling Industry, and Integrated Steel Industry which do it all. And as we know now, this is again one type of segmentation that is done through the products which individual companies make. Each of these industries adds value. Again, we are concerned with the industry which adds the most value. This is done through a technique called profit pool analysis.

- Profit Pool Analysis and selecting the best segment where the most value lies.

There are two things we are trying to find from the start: 1) First, is the steel sector attractive to invest in, and this answer we got through Global Steel and Indian Steel comparison, Recent Indian government policies, and geo-political scenarios. 2) Secondly, finding that part of the Steel Sector that adds the most value i.e., high growth and profitability going ahead.

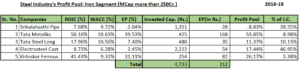

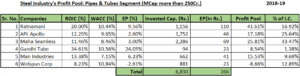

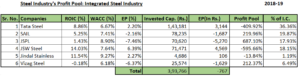

The 2nd part requires an understanding of Segmentation, Industry Risk & Advantages, Value Chain, and Profit Pool. Profit Pool is the only quantitative step and hence important. Profit Pool analysis is done for each of the 3 industries identified in the value chain because those are the only listed industries to work with. Profit Pool is done through a data-intensive output table as below:

- Iron Industry:

- Pipes & Tubes Industry (A sub-segment of the Secondary Steel Industry):

- Integrated Steel Industry:

From the above tables, we see that the integrated steel industry is not so attractive in terms of Economic Profit (ROIC-WACC). And the amount of invested capital is just too huge as compared to the profits they generate. Hence, not an industry of choice to be in as the profitability of the industry is either temporarily curtailed or the industry is bad.

Out of the two i.e., Iron Industry and Pipes & Tubes Industry; both are good enough to generate Economic Profits. So, both the industry is good enough to select. But as we read more about each industry, we realize that the consistency of profitability for pipes & tubes is better than in the iron industry. And also, growth prospect is better poised for the Pipes & Tubes Industry going ahead.

- Concluding:

Hence, from the above: based on quantitative as well as qualitative understanding; the Pipes & Tubes Industry is better placed to take the advantage of increased growth and profits going ahead. We will know why in Part 2 of the blog i.e., Pipes & Tubes Industry in detail.