Value migration in very simple terms is ‘Shift in businesses (Revenue/Profit/etc.) from one company/industry/country/etc. to another due to change in business models that satisfies the need of customers most important priority in very efficient and low cost way. So, when customers switch their Bank Accounts from Public bank to Private bank, it is termed as value migration to Private Banks. Why customer shifts? Because of better service, good interest rates, technology enabling transaction at finger tips i.e. the latest UPI technology for transferring money in seconds and many more things.

Let me give you one very simple and identifiable example, and quite famous one. Have a look at the two images below:

Do you remember the transformation from steel pipes to PCV pipes? Do you even remember steel buckets being used way back which are now replaced by Plastic buckets?

This is a classic example of “Value Migration”. The value has moved from Steel Pipes/Buckets to Plastic Pipes and Buckets. And because of better utility, cheaper pricing, and easy to handle amongst many other things.

And, there are way too many examples to give. Some of which even you can spot around in your daily life. Few of which I would definitely like to point out:

- Use of internet and requirement of Wi-Fi at home.

- Use of online shopping i.e. e-commerce websites.

- The increased awareness and initiative of doing SIP’s recently has led to shift in making FD’s and RD’s to SIP’s for saving. (Remember the advertisement “Mutual Fund Sahi Hai”.)

- Shift of Public banks to Private Banks for better service.

- Use of Laptop as opposed to Desktop.

- Use of Smart Phones as opposed to old school keypad phones.

- Use of CD’s v/s Use of Pen drives.

- Increased use of Cloud Servers i.e. Google Drive, Drop Box etc. as opposed to keeping pen drive.

- And the latest, the trend of Video Lectures these days. By School, Colleges, etc.

It is very important to note these developments in our life. As far as investing is considered, it becomes even more important to identify these trends early. This will help us in finding a right industry/stock to further research and invest our money for long term wealth creation.

And to excite you even more, just check out the long term historical share prices of Astral Poly (PVC Pipes maker), HDFC Bank and ICICI Bank (Private Banks), Google (Cloud Server), Amazon (e-commerce), HDFC AMC (SIP and related).

You might find many such companies, it is just your interest that will drive you to have a look at their prices.

But, identifying Value Migration is not a single step process. As you know Pen Drives destroyed CD’s market and Cloud Servers is destroying Pen Drive’s market. So, it is even more important to keep tracking these industries and their products to understand any new product coming up which leads to value migration to different places.

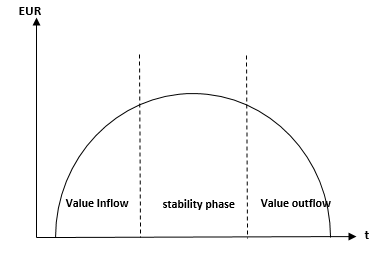

Typically there are 3 stages of Value Migration and Value Migration might happen at many places.

- Three stages: (Explanation in short and simple terms)

Stage 1: Value Inflow.

So, the very first time when the PVC Pipes were discovered/invented. It was a whole new concept and danger to Steel Pipes for plumbing work. Slowly, people started to realise that PVC Pipes are actually more cost efficient and have better utility then steel pipes. Steel pipes have all sort of disadvantage like corrosion, difficult to handle and replace, high cost, etc. Hence, many builders/plumbers and other users started to realize this and there was a very slow and swift shift to the PVC Pipes industry. Soon, where the knowledge was spread across countries, the adaption of PVC Pipes became very fast. And a whole new industry in name of PVC Pipes were formed. This is simple Value Inflow to PVC Pipes Industry and came in expense of outflow from steel pipes.

Stage 2: Value Stabilizing.

Talking on same lines as above. So, slowly the shift was there from Steel Pipes to PVC Pipes. But, how much actually PVC Pipes can grow? A common sense indicates that hypothetically whole of steel pipes demand will be replaced by PVC Pipes. Hence, PVC Pipes demand was only restricted to the demand generated by steel pipes earlier. It was still possible to grow even higher than the steel pipes, only when PVC companies find new ways to replace its PVC Pipes with other products (other than steel pipes). Hence, when the whole shift happens, new demand will slow down. Also, seeing high profitability in the industry many new players will come up. This will lead to competition, limited profitability, limited demand company wise, etc. This is the time when the growth stabilizes and the industry settles back to normal levels.

Stage 3:Value Outflow.

So, similar to steel pipes being replaced by PVC Pipes. PVC Pipes even have danger of itself being replaced by new upcoming innovative product. For now, let us say we do not know that. But, we know that steel pipes demand were continuous decreasing. Hence, there was Value Outflow from steel pipes. Similarly, there was value outflow form CD’s industry and currently Pen Drive industry are on the risk of Value Outflow.

Hence, there is a pattern in value migration.

Pattern: Value Inflow > Value Stabilizing > Value Outflow

Till the time, companies do not continuously thrive to update themselves with new upcoming projects and technologies to sustain in the market. Most of the time value outflow happens. Hence, if companies are very quick in adapting and innovating new technologies and products, we might see them continuously improving their sales through different Value Inflow and Value Stabilizing techniques.

- Value Migration Happens at:

1) Value Migration from one country to other.

2) Value Migration from one industry to another.

3) Value Migration from one segment in an industry to another.

4) Value Migration from one company to other.

Just briefing you the above value migration. Value Migration does not happen only from one perspective i.e. new product innovation. There are many ways through which value migration happens. Remember, value migration simply is to be seen from Sale prospective.

So, recent US-China tension and trade war have benefited our country. Right? Simply seen, the orders are more coming to India which earlier used to go to China. Hence, Value Migration or Sales have shifted from China to India (Value Migration of Countries). Similarly, the orders of PVC Pipes from steel pipes is Value Migration across different Industry/Sector. Within a sector/industry there are chances of value migration. Recent banning/restricted use of plastic products have led the packaging industry to produce packing materials of paper, aluminium or jute (Segment within packing industry) in place of plastic packing. And the last example of Value Migration from One company to another can be seen in customers switching from Public Banks to Private Banks.

Source:

Motilal Oswal’s brilliant paper: Value Migration 2.0: Digging deeper, exploring more themes.

Disclaimer:

Views are personal and presented through independent research. By no means there is any stock advice. Also, presented content is for learning purpose only. I might be wrong in presenting data and inaccurate data, let me know if you find any discrepancies.