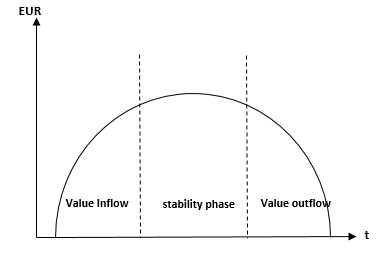

Value Migration is shift of Revenue/Value from current product/segment/part to some other products/segment/part. For Steel Pipes & Tubes, we know from “Threat of Substitute”, the possibility of Plastic Pipes replacing Steel Pipes and their past as well. There, it was threat to our segment i.e. steel being replaced by Plastics. But here we focus on opportunities which steel pipes & tubes manufacturers might enjoy due to Value Migration. Plastic Pipes like PVC, CPVC, and HDPE Pipes have already had a greater share of value migration from Steel ERW Plumbing Pipes. So, where it is value migration for one company, it becomes part of “Threat of Substitute” for others. So, Threat of Substitute runs sort of opposite to Value Migration. Let us now try to understand the important advancements in our segment of Steel Pipes & Tubes in terms of value migration.

As we all know, our product is categorised into SAW Pipes, Seamless Pipes and ERW Pipes. Hence, most part of my explanation will be revolving around product categories. Look at the below point by point explanation:

- Seamless Pipe companies making a possible import substitute?

Seamless Pipes are very complex product to make involving Hot Extrusion process to convert bars, billets into seamless pipes. Seamless pipes do not have any welds and hence are capable to take very high pressures of Oil, Gas, Chemicals, etc. This is the main reason why they command very high premium & pricing. There are only 3-4 companies in India making seamless pipes namely Maharashtra Seamless Limited, Ratnamani Metals, Gandhi Metals, Jindal SAW and ISMT Limited. Also, you will find surprising that we import seamless pipes for better quality requirement from countries like Japan, Vietnam, Korea and China.

So, there are two value migration happening for companies who are able to produce higher quality and for niche markets. They are inter-country benefit and inter-segment benefit. Let me explain in simple terms:

Historically seamless pipes are imported in huge quantities to India. Now, due to emerging companies like Ratnamani, very high quality of seamless pipes itself are made in India, although available at expensive rates (due to higher cost of production). Because of such advancement there is value migration from other countries to India i.e. imported product are now bought from in-house producers. Also, Ratnamani is the only company in India making high quality seamless pipes with alloy materials like titanium, Inconel, Monel, duplex, super-duplex, etc.

So, Ratnamani Metal’s capability to make products of equivalent standards as import is very important value migration. Value Migration of inter-country and inter-segment. Inter-segment products like the making Heat Exchanger Tubes, special alloy pipes for high pressure requirement of defence, aerospace, power, etc. which are also import substitute.

- ERW a new opportunity?

APL Apollo and Surya Roshni are major producers in ERW Pipes & Tubes categories. ERW is experiencing superb growth from past few years. Company are able to grow very fast and hence it gives indication that ERW segment might have entered into high-margin products and altogether found new market opportunities for itself to expand. Look at the growth of ERW segment:

The growth is fantastic when we look at the sales figures from 4, 18,440 M.T. in 2011 to 21, 12,050 M.T.

There are many reasons for this shift which I could explain you as below:

ERW Segment is finding a lot of new opportunities into various industries and segments. ERW Pipes is considered as replacement of Wood. How? We have seen at lots of areas where wood is being used. It is used to make fencing, furniture, entrance gate, doors and so on. Just observe around and you will find wood replacing with steel. Fencing, Doors, Balconies, Furniture, etc. are now being replaced by steel. For affordability factor, ERW Pipes are better options over wood. Steel Pipes are considered 1/3rd cost of wood, and 3 times the durability (Source: APL Apollo Concalls). With trending fabrication techniques and new designs in steel segment, wood is easily being replaced by steel to both satisfy the utility with lower costs and with designs. Usage of wood itself is very big market and value migration to steel pipes gives prospect for higher opportunities.

Apart from Wood, one more important thing I would like to point out is migration of inter-segment products i.e. long product like channels, angles & beams to ERW Square Pipes. Structural steel is category of steel that is used to make various kinds of shapes in construction & infrastructure industry. Shapes are formed with steel to make architectural designs of airports, bridges, and so on. Historically Angles, Channels & Beams were considered as only structural items to make these architectural designs but development of hollow sections have shifted the preposition. Light weight, equally strong and cheaper hollow sections are finding easy to replace angles, channels & beams. This is very important value migration as well because the market of structural steel is huge and so the possible opportunities for hollow/ERW pipes would also be huge.

Hence, we see value migration here as well. Value migration of inter-segment from angles & channels to hollow pipes

- SAW Pipes expanding its opportunities?

SAW pipes are very complex to make. There are two types of SAW Pipes, LSAW & HSAW. LSAW possess high thickness but could not be made in high diameter sizes and HSAW have low thickness and can be made into higher diameter sizes. Now, for LSAW it is difficult to produce higher diameter pipes and it is similarly difficult for HSAW to be of high thickness. And this problem solving will open up market opportunities of SAW Pipes companies.

Indian company especially Welspun Corp. is able to extend its product range in terms of thickness and size for both LSAW and HSAW Pipes. These thickness requirement along with size is important for off-shore pipelines laid down under sea, where transportation is of crucial chemical items, oils and gas. Hence, this new advancement of higher thickness and higher size is creating new opportunities which Indian SAW Pipes manufacturer are getting into. Being a complex product category and size/thickness requirement for specific usage, there is lot more to understand about SAW pipes and the opportunities which it can expand to. But as of now, with slight certainty I can say that SAW Pipes are extending its opportunities to new industries, new countries by making export focused special products required by clients.

Another possibility for new opportunity for SAW products is value migration from D.I. Pipes to SAW Pipe. Much has been said in “Threat of substitute” part and hence not explained.

- Other Points:

Now, we observed that value migration is happening in our product category. And there are especially more opportunities available for ERW and Seamless pipes followed by SAW Pipes. But there are few aspects which requires attention. The very first aspect is: “Whether value migration is happening profitability” i.e. the value migration is bringing profit to our steel pipes & tubes segment or not? Value migration can only be beneficial if it also brings profitability as growth without profits is useless. For this, we need to analyse the industry/segment which steel pipes & tubes is replacing.

Firstly, if the products are finding its opportunities to niche segment and retail category, the profitability is higher. Special SAW Pipes developed by Welspun Corp. and Ratnamani developing seamless pipe for niche categories are always profitable ventures to get in.

For ERW Pipes, companies like APL Apollo are getting into B2C category. Margins when sold to retail category is generally higher when compared with margins to direct companies. This is because, if companies buy, they have higher bargain power and hence margins reduces. We observe through APL Apollo’s AR that they are venturing into strategies to get into B2C categories sales. Currently, major part of APL’s revenue is coming from industries like construction and infrastructure. So, ERW segment of APL Apollo is having a mixed buyers i.e. retail & corporates. So, t is really a company specific focus which could lead to value migration profitably.

Another important point for value migration is shift of organised v/s unorganised sectors. Where SAW and Seamless pipes are only work of organised sector, there are many unorganised players in ERW segment. Due to demonetisation, GST and specially COVID, there is a shift of balance towards organised segment. With higher cost of production for unorganised segment due to less economies of scale, the organised players with PAN India presence are able to expand very significantly and have taken the share of unorganised market. This is another import value migration within the segment i.e. from unorganised to organised market.

Hence, where value migration is happening. We can see that it is also giving higher profits for major areas of Pipes & Tubes segment. Apart from this, there are many other positives for all the product categories. The greater positive being introduction of “Anti-Dumping duty”. It was in 2011 time period where China has started dumping their steel products at unbelievable prices, all over the world. This led to disruption of steel price discipline at the world level. To combat such issues, many companies have started imposing anti-dumping duty on Chinese imports. Many governments like U.K, USA, Germany have put restriction on Chinese imports. After China, India is largest producer country in the world, which means higher duty on Chinese import will lead to shift of value migration to Indian companies. Since then, India’s export have also been on a rise and this is expected to happen in future as well. Apart from this, the trade tensions of many countries with China is also seen as positive for Indian steel industry. USA’s tension with China has led to USA banning many Chinese products. So, the order requirements are mostly shifting to Indian companies and this has added a greater catalyst to India’s steel industry. You might want to check out the data for export, import, etc. again: Steel’s Opportunity Size.

- Conclusion:

Hence, there are lots of positive for Steel Pipes & Tubes industry. Firstly, there is Value Migration observed. Value migration is observed strongly for Seamless Pipes & Tubes segment and ERW Segment. We have seen very important development in value migration with higher profitability especially for alloy products of seamless category. So, the opportunity coming due to value migration is very good.

Also, steel pipes & tubes have been able to access many new industries as well. Use of ERW into Solar, Infrastructure, and Structural Steel is very healthy development. Also, seamless category is also expanding its use to many newer industries. So, there is widening of opportunity size. “The combination of High Entry Barrier with widening opportunity size is very good news for our segment going ahead.”

Disclaimer: Views are personal and presented through independent research. By no means there is any stock advice. Also, presented content is for learning purpose only. I might be wrong in presenting data and inaccurate data, let me know if you find any discrepancies.

Pingback: 23. Major trends we observe in Steel Pipes & Tubes Segment. – Wittiest Investing